Top Factors Driving Growth in the Brazil Agricultural machinery market

Overview of Brazil's Agricultural Machinery Industry:

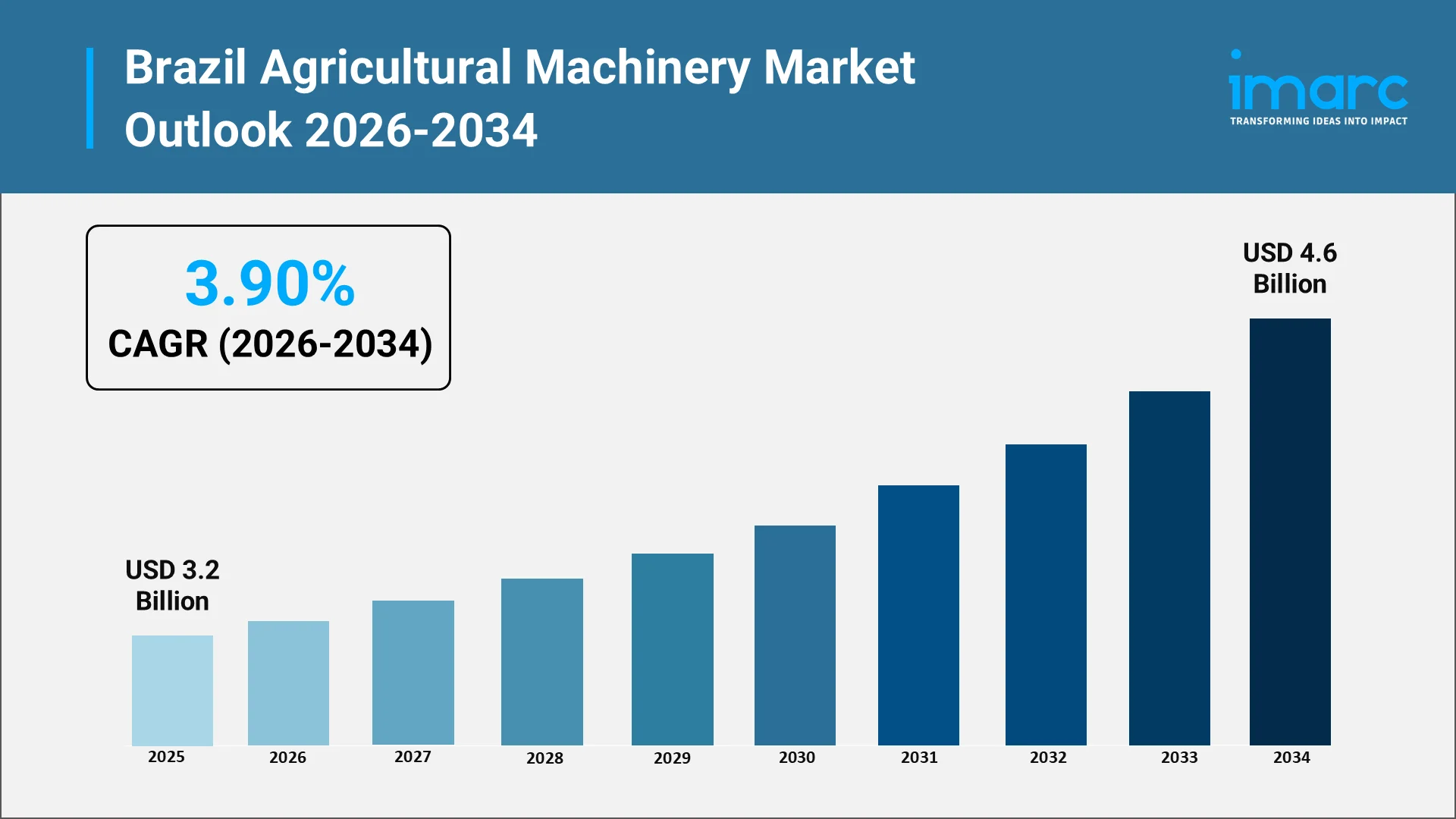

The Brazil agricultural machinery market stands as a cornerstone of the nation's agricultural modernization drive, experiencing robust expansion fueled by technological innovation, government support initiatives, and the imperative to enhance agricultural productivity across the world's largest soybean producer. According to IMARC Group's comprehensive market analysis, the Brazil agricultural machinery market reached a valuation of USD 3.2 Billion in 2025, reflecting the accelerating adoption of advanced farm equipment Brazil offers across diverse agricultural landscapes spanning grain production, sugarcane cultivation, coffee farming, and livestock operations. This impressive growth trajectory positions the industry for continued prosperity, with projections indicating the market will reach USD 4.6 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 3.90% during the 2026-2034 forecast period.

Explore in-depth findings for this market, Request Sample

The market's expansion is fundamentally driven by Brazil's position as a global agricultural powerhouse. The machinery market encompasses diverse product categories including tractors across horsepower ranges, ploughing and cultivating equipment, planting machinery with precision seeders, harvesting solutions featuring combine harvesters and balers, haying equipment, and sophisticated irrigation systems essential for Brazil's varied climatic conditions. The integration of smart farming technology throughout equipment offerings, including GPS guidance systems, telemetry platforms, and autonomous machinery capabilities, positions the market as a critical enabler of sustainable agricultural intensification supporting domestic food security objectives and maintaining Brazil's competitive advantages in global commodity markets through productivity enhancements and resource optimization.

Market Growth Outlook and Production Statistics:

The Brazil agricultural machinery market demonstrates robust expansion supported by impressive agricultural production achievements and favorable economic indicators reinforcing investment confidence across the sector.

- Agricultural Gross Production Value Reached Record Levels: Brazil's Gross Production Value for the agricultural sector in the 2025 harvest reached R$ 1.41 trillion based on January data, marking an 11% increase over the 2024 cycle (R$ 1.27 trillion), according to calculations by the Agricultural Policy Secretariat of the Ministry of Agriculture using data from the Brazilian Institute of Geography and Statistics (IBGE) and the National Supply Company (Conab). The commodities with the highest growth included coffee (+46.1%), corn (+16.7%), and soybeans (+13.4%), directly stimulating demand for specialized harvesting and processing machinery.

- GDP Growth Driven by Agricultural Performance: Brazil's Gross Domestic Product (GDP) grew by 1.4% from Q4 2024 to Q1 2025, with agriculture recording exceptional growth of 12.2% against Q4 2024, significantly outpacing other economic sectors, as reported by IBGE's System of National Accounts released in June 2025. This agricultural expansion generated substantial income growth enabling farmers to invest in modern machinery and equipment upgrades.

- Record Soybean and Corn Production Volumes: Brazil’s National Supply Company projects soybean acreage to rise by 3.5% to 121 Million acres, positioning the country for a potential record harvest of 6.5 Billion bushels. Corn acreage is forecast to expand by 4% to 56 Million acres, with production estimated at 5.46 Billion bushels, about 2% lower than the previous season. This scale expansion directly increases demand for high-capacity tractors, planters, and harvesting equipment capable of managing larger production volumes efficiently.

- Manufacturing Industry Advances with Machinery Production: Brazil’s Gross Domestic Product (GDP) grew by 1.4% between the fourth quarter of 2024 and the first quarter of 2025. The growth was mainly driven by a strong 12.2% expansion in the agricultural sector, supported by favorable harvests and higher output, along with a modest 0.3% rise in the services sector, according to IBGE quarterly GDP data released in May 2025. This growth reflects both domestic consumption and export demand for Brazilian-manufactured agricultural machinery, with approximately 90% of equipment sold domestically produced within the country at facilities operated by major international manufacturers.

Key Drivers of Mechanization in Agriculture:

Multiple converging factors propel mechanization adoption throughout Brazil's agricultural sector, fundamentally transforming farming operations and driving sustained demand growth for farm equipment Brazil requires.

- Farm Consolidation and Scale Economies: Large-scale agricultural operations, particularly in the Central-West region encompassing Mato Grosso, Goias, and Mato Grosso do Sul states, continue expanding through acquisition of smaller farms, creating consolidated properties exceeding thousands of hectares. These mega-farms require extensive machinery fleets including multiple high-horsepower tractors, wide-width planters, and high-capacity harvesters to manage planting and harvesting operations within optimal weather windows, generating substantial equipment demand concentrated among large commercial producers.

- Labor Shortage Crisis Accelerating Automation: Brazil's agricultural sector faces acute labor shortages exacerbated by rural-to-urban migration patterns, with farmers reporting persistent difficulties recruiting adequate workers for seasonal operations including planting, weeding, and harvesting activities. Rising agricultural labor costs further incentivize mechanization investments that reduce manual labor requirements while maintaining or enhancing productivity levels through precision application and efficient field operations.

- Precision Agriculture Technology Adoption: The rapid integration of smart farming technology, including GPS-guided tractors, variable rate application systems, automated steering solutions, and telematics platforms for fleet management, enables farmers to optimize input utilization, reduce waste, and enhance crop yields through data-driven decision-making. The majority of Brazilian farms now deploy digital platforms for real-time crop management, driving operating-cost savings while elevating yields and creating sustained demand for technology-enabled machinery.

Government Policies and Investment Trends:

The Brazilian government demonstrates comprehensive commitment to agricultural mechanization through robust policy frameworks and substantial financial investments designed to accelerate technology adoption, enhance sectoral productivity, and strengthen competitiveness across domestic and export markets. Federal initiatives provide critical support mechanisms including subsidized credit lines, tax incentives, and strategic investment programs that reduce financial barriers for farmers seeking to modernize operations with advanced machinery.

The government recognizes that agricultural productivity improvements through mechanization directly contribute to national food security objectives, export competitiveness, rural economic development, and sustainable farming practices addressing environmental challenges. These strategic investments, totaling hundreds of Billions of reais across multiple programs, acknowledge agriculture's fundamental role contributing to Brazil's GDP through value-added activities, positioning mechanization support as essential national economic policy.

- Plano Safra 2025/2026 - Comprehensive Agricultural Credit Program (June 2025): The Brazilian government has launched the Plano Safra 2025/2026, allocating BRL 516.2 billion to finance agriculture and livestock production across the country. Of this total, BRL 447 billion will support large-scale rural producers and cooperatives, while BRL 69.1 billion will fund producers participating in the National Program to Support Medium-Sized Rural Producers (Pronamp). The program represents an increase of BRL 8 billion compared with the previous year and encompasses credit for production, marketing, and investment operations. Financing conditions vary according to the producer’s profile and the specific credit line accessed. Within the total allocation, BRL 414.7 billion will be directed toward financing and marketing, and BRL 101.5 billion will support investment operations. Annual interest rates for financing and marketing loans are set at 10 percent for Pronamp producers and 14 percent for other producers. Investment loans will carry interest rates ranging from 8.55% to 13.5%, depending on the program and borrower profile.

- Plano Safra da Agricultura Familiar 2025/2026 - Family Farming Support Initiative (June 2025): Complementing commercial agriculture support, the Brazilian government allocated BRL 89 Billion for the Family Farming Harvest Plan (Plano Safra da Agricultura Familiar 2025/2026), with BRL 78.2 Billion designated for PRONAF (National Program for Strengthening Family Farming) representing a 47.5% increase in rural credit compared to the previous administration, as announced by President Luiz Inacio Lula da Silva and the Ministry of Agrarian Development and Family Agriculture on June 30, 2025. The program maintains exceptionally low interest rates of 3% annually for basic food production financing and 2% for organic and agroecological farming, while substantially expanding mechanization support through increased equipment purchase limits and subsidized financing terms specifically designed for family farmers operating smaller landholdings.

- New Industry Brazil - Agro-Industrial Development Program (December 2024): In December 2024, President Lula announced the comprehensive New Industry Brazil initiative allocating BRL 546.6 Billion to boost sustainable agro-industrial chains, with BRL 250.2 Billion in public resources through credit lines and an expected BRL 296.3 Billion in private investments by 2029. The program established ambitious mechanization targets including increasing family farming mechanization rates from 25% to 28% by 2026 and 35% by 2033, recognizing tractors and implements as essential tools for productivity enhancement. Additionally, Banco do Brasil joined the More Production Plan providing BRL 101 Billion in credit lines specifically supporting machinery purchases and farm modernization investments.

Technological Integration and Smart Farming:

Smart farming technology integration throughout Brazil's agricultural machinery sector represents a transformative shift fundamentally reshaping equipment capabilities, farmer expectations, and competitive dynamics across the market. Brazilian manufacturers and international brands operating in the country are increasingly embedding advanced digital technologies including GPS guidance systems, telematics platforms, IoT sensors, artificial intelligence-powered analytics, and autonomous operation capabilities into tractors, harvesters, planters, and sprayers. This technological evolution enables precision agriculture practices that optimize input application, reduce waste, enhance environmental sustainability, and improve farm profitability through data-driven decision-making. Major machinery manufacturers recognize that technology differentiation increasingly drives purchasing decisions as farmers seek integrated equipment-software solutions delivering measurable return on investment through fuel savings, input optimization, yield improvements, and reduced labor requirements.

- September 2025 - Jacto Introduces T100 Drone and DJI Drone Partnership: At Expointer 2025, Brazilian manufacturer Jacto showcased the T100 agricultural drone with high operational capacity, with a 100-liter liquid tank and an optional 100-kg solids system, enabling fewer stops and higher productivity. Jacto’s booth also featured tractor-mounted and self-propelled sprayers, planters, spreaders, digital solutions, and agricultural drones.

- May 2025 - John Deere Unveils Ethanol-Powered Prototype Tractor: At Agrishow 2025, Deere & Company launched an ethanol-powered 8R tractor prototype designed to reduce emissions while maintaining performance for Brazilian agricultural operations, leveraging Brazil's established ethanol infrastructure developed through decades of biofuel production from sugarcane.

- April 2025 - CNH Industrial Showcases 15+ New Agricultural Products: At Agrishow 2025 in Brazil, CNH Industrial's New Holland brand unveiled more than 15 new agricultural products showcasing latest machinery innovations tailored to Brazilian farming requirements. The exhibition featured updated T8, T7, and T5 tractor models incorporating advanced transmission technologies, enhanced cab comfort and visibility, integrated precision agriculture systems, and improved fuel efficiency.

- December 2024 - John Deere Establishes Brazilian Technology Development Center: John Deere announced completion of the world's first development and testing center for tropical agriculture in Indaiatuba, Sao Paulo, with R$180 Million invested in the facility designed to accelerate product development specifically for Brazilian agricultural conditions considering variables including soil types, climate patterns, connectivity infrastructure levels, and local farming practices.

- May 2024 - CNH Industrial Launches Automated Harvester with AI Capabilities: CNH Industrial N.V.'s Case IH brand introduced the Axial-Flow Series 160 Automation harvesters manufactured at its Sorocaba facility in Sao Paulo, Brazil, featuring advanced automation capabilities that automatically execute up to 1,800 daily adjustments optimizing grain quality and throughput based on crop conditions monitored through onboard sensors and AI algorithms.

Competitive Environment and Future Prospects:

The market exhibits moderate concentration with leading international manufacturers commanding substantial farm equipment Brazil market shares while domestic Brazilian producers maintain competitive positions through specialized offerings and localized advantages. Localization strategies dominate competitive positioning, with Deere & Company, AGCO Corporation, and CNH Industrial N.V. all operating foundries, transmission manufacturing, and implement production facilities within Brazil. This domestic manufacturing insulates cost structures from exchange rate volatility affecting imported equipment while qualifying companies for preferential treatment under government credit programs favoring locally produced machinery.

Looking forward, the Brazil agricultural machinery market outlook appears exceptionally promising, characterized by sustained government support through record credit allocations exceeding BRL 600 Billion annually, continuous agricultural expansion into frontier regions, technology adoption accelerating across all farm sizes, and Brazil's growing importance as global agricultural supplier necessitating productivity investments. Autonomous machinery will transition from demonstration projects to commercial deployment, particularly in large-scale grain operations where labor costs and availability constraints justify premium pricing for self-driving tractors and harvesters. The market will also experience increasing segmentation with manufacturers developing specialized equipment for sugarcane mechanization, coffee harvesting automation, livestock operation optimization, and emerging crop opportunities including cotton and specialty grains expanding in frontier regions.

Choose IMARC for the Analysis of the Brazil Agricultural Machinery Market:

For comprehensive, data-driven insights into the Brazil agricultural machinery market, IMARC Group stands as the premier choice delivering unparalleled market intelligence that empowers strategic decision-making across manufacturing, investment, distribution, and operational planning contexts throughout this dynamic and rapidly evolving industry.

- Comprehensive Market Coverage Across All Equipment Categories: IMARC delivers exhaustive analysis spanning all agricultural machinery segments essential for diverse Brazilian climatic conditions. This complete market visibility enables manufacturers to identify underserved segments, optimize product portfolio allocation, and develop targeted market entry strategies maximizing return on investment across multiple equipment categories.

- Accurate Forecasting Methodology and Regional Insights: Our research employs robust forecasting methodologies incorporating historical market performance data spanning multiple harvest cycles, macroeconomic indicators. IMARC provides granular regional analysis covering Southeast, South, Northeast, North, and Central-West regions, revealing specific growth opportunities and competitive dynamics within Brazil's diverse agricultural landscapes.

- Competitive Intelligence Profiling Major Market Participants: IMARC provides detailed competitive landscape analysis profiling leading international manufacturers. Our analysis examines market share distributions by equipment category and region, strategic initiatives, enabling clients to understand competitive positioning and identify differentiation opportunities.

- Technology Trend Analysis and Smart Farming Integration: IMARC monitors evolving technology adoption. Our analysis evaluates technology vendor partnerships, smart farming technology ROI calculations influencing adoption rates, and regional variation in precision agriculture implementation, helping manufacturers prioritize R&D investments, technology licensing partnerships, and product development roadmaps aligned with farmer expectations and competitive requirements throughout the Brazil agricultural machinery market.

- Regulatory Framework and Government Policy Guidance: IMARC tracks evolving government policies. This regulatory intelligence helps stakeholders navigate compliance requirements, capitalize on government incentive programs supporting mechanization investments, and anticipate policy changes affecting market conditions.

- Proven Track Record Serving Agricultural Equipment Industry Clients: Organizations globally trust IMARC's research quality, analytical rigor, timely delivery, and responsive client service. Our expertise serving agricultural machinery manufacturers, component suppliers, dealers, financial institutions, and investors throughout Latin America provides deep contextual understanding of Brazilian market dynamics.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)